Take control of your life - Live Debt-Free!

CALL NOW for a Free Consultation! 801-635-4554 Serving all 50 States!

With the right financial coaching, you will be empowered to control your money, save for your future, & change your life!

Signed in as:

filler@godaddy.com

With the right financial coaching, you will be empowered to control your money, save for your future, & change your life!

Servicing clients in all 50 states.

Dave Ramsey Certified Master Coach and Endorsed Local Provider

Live Zoom Meetings available. In person for all clients in the local Salt Lake City area!

I coach high school and college students on the importance of personal finance and smart money management. Students learn how to manage their earnings, track expenses, and build savings for emergencies and future goals. Knowledge is power, and young people need a solid understanding of financial basics. I teach them how to avoid common pitfalls such as credit card debt, impulse spending, and social pressure, while helping them plan for college and make confident financial decisions that set them up for long‑term success.

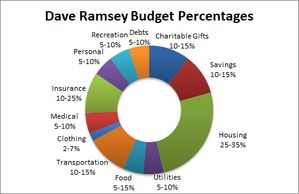

Learning to budget is one of the most important steps in managing your finances. When you know exactly where your money goes each month, you can finally break the cycle of living paycheck to paycheck. Giving every dollar a purpose helps you see your spending habits clearly and understand where changes need to be made.

Budgeting is about reconnecting with your money and taking back control—so your finances no longer control you.

Debt management is one of the most important steps in building long‑term wealth, but it’s only the beginning. Adopting a new way of managing your money sets you up for the future—helping you prepare for emergencies, plan for retirement, protect your family, and experience the joy of giving in a more meaningful way.

I work alongside a network of trusted professionals who can support you throughout this life‑changing journey.

Individual and couples therapists are also available upon request.

This is the moment where everything can shift. When you decide to take control of your money, you’re not just fixing numbers on a page—you’re rebuilding confidence, restoring balance, and creating space for the life you were meant to live. Financial stress doesn’t have to define your days or dictate your future. With the right guidance, support, and a clear plan, you can break old patterns, build healthier habits, and experience a level of freedom you may not have felt in years.

Living an intentional, purpose‑driven life begins with choosing change. It’s the moment you decide you’re done carrying the weight of financial stress—stress that affects your health, your relationships, and your sense of direction. As you gain control and clarity, you also gain the ability to give more freely, to support the people and causes you care about, and to live with a generosity that reflects your values.

If you’re ready to breathe again, to feel grounded and hopeful, and to take meaningful steps toward a more intentional, purpose‑filled future, NewLife Financial Coaching is here to walk with you. Together, we’ll build a path that supports the life you were created to live.

A NewLife!

Whatever your situation, you don’t have to face it on your own. I’m here to walk with you through every step of this process.

The reasons behind your debt don’t define you—and they don’t determine your future. There is no judgment and no shame here. What matters is that you’re ready to take a step forward and create real change.

Your privacy and safety are always protected. All information you share is completely confidential. You will never be asked for account numbers, passwords, or Social Security numbers. There are no contracts, no pressure, and you remain in full control of your decisions.

With NewLife Financial Coaching, you’re in a safe, supportive place to rebuild confidence, gain clarity, and move toward a healthier financial life.

Compound interest can work for you—but when it comes to credit cards, it often works against you. High interest rates mean your balance grows faster than you realize, and even small purchases can take years to pay off if you’re only making minimum payments.

Do you know how long it will take to pay off your current credit card debt. Most people don’t. At an average interest rate of 20–25%, a balance of just $5,000 can take more than 20 years to pay off with minimum payments, and you could end up paying double—or even triple—the original amount. That’s the power of compound interest in reverse.

Are the purchases you made worth the extra interest you’re now paying. Understanding where you stand is the first step toward taking back control.

You’re not stuck. You can break this cycle, and you can get ahead. Let me show you how to stop compound interest from draining your future and start using your money with purpose and confidence.

Gift Certificates make great gifts for friends, relatives and employees.

You will get 50% off a booked LightHouse session with the purchase of any gift card. That's a savings of over $200 for you!

Minimum gift card amount $200 to qualify.